More can be thrown in there, but, regardless, it would be a tad bit difficult to categorize throwing $87,000 into a truck without consulting your partner of 2 years right before you’re due to move in.

While it is tempting to buy a new toy to drive around in, it’s important to not lose sight of one’s financial priorities too

Image credits: YuriArcursPeopleimages/ Envato elements (not the actual photo)

That, alas, wasn’t the case when this boyfriend spent $87K on a truck behind his girlfriend’s back and now there’s issues

Image credits: Notmovingin_

For the time being, the woman decided to back out and take a break before it’s all sorted out

Image credits: MART PRODUCTION/Pexels (not the actual photo)

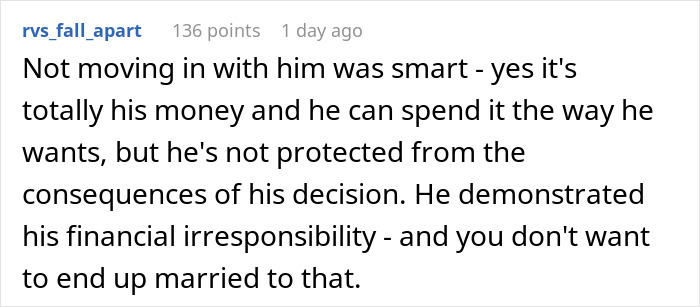

The story goes that a woman recently found out that her boyfriend of 2 years went behind her back and bought an $87,000 truck.

For context, this was in light of the fact that they were moving in together very soon, and there were plans on marriage and all that jazz. Needless to say, that money would’ve been very helpful. He didn’t even need a truck.

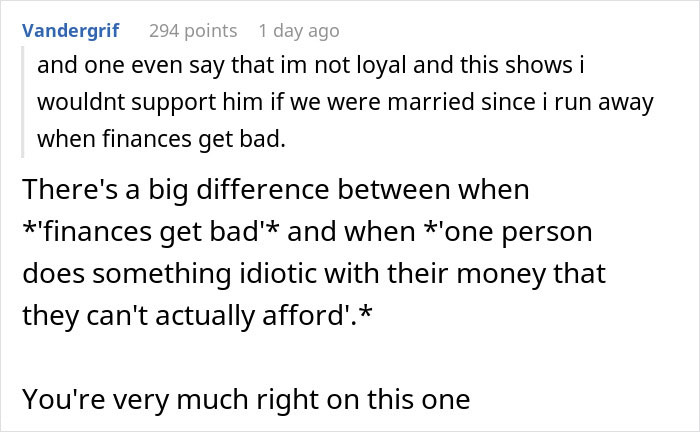

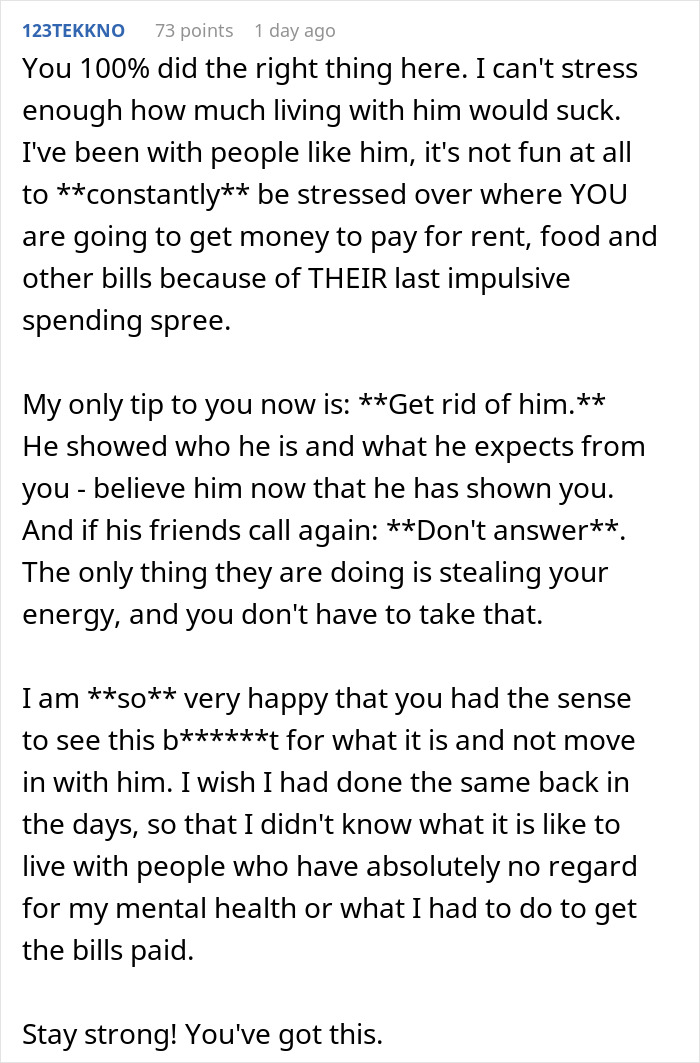

Well, the woman wasn’t impressed when he showed her the truck. An argument ensued, leading to a break in the relationship. The guy’s friends tried to talk OP into “being more supportive”, but you can probably see how redonculous that sounds.

And folks in the comments were pretty much of the same opinion. Many praised OP for recognizing a bad situation when she saw it and putting herself first. Some suspected that the guy was hoping she’d cover the other expenses while he pays off the truck. And it’s behavior that leads to a Ferrari one day.

Finances are a huge part of any committed relationship and impulse buys to that degree have no place in them

Image credits: cottonbro studio/Pexels (not the actual photo)

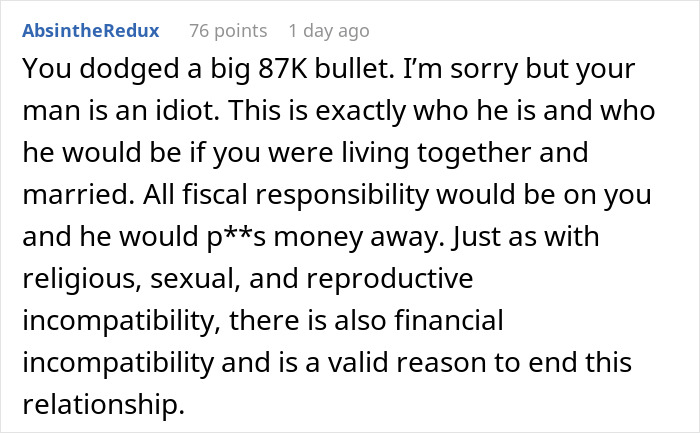

Family finances and budgeting are a huge topic that’s widely discussed by many. If that part is not sorted out by the couple, it can leave them feeling stressed and financially vulnerable.

Budgeting and being smart about family money is the surest way to ensure financial stability because knowing your realistic monetary numbers means being sure the family needs, savings and emergencies are all covered. Future goals too.

Approaching this transparently is a must. Open communication on the topic is a way for families to bond, voice opinions, be heard, and reach decisions together. This in turn can foster a financial discipline that can serve as a great way to teach the kids about financial commitments and responsibility.

But you gotta talk about it. That is key.

So, what are your thoughts on anything and everything you’ve read here today? Share your takes and stories in the comment section below! And once you’re done with that, why not read some more.