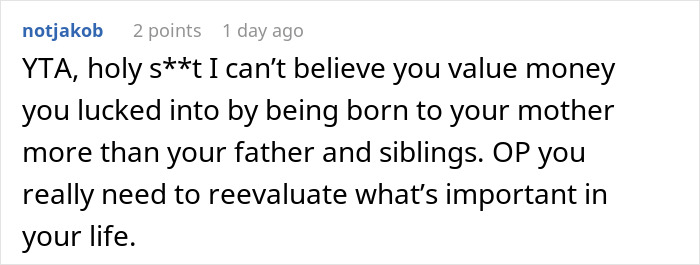

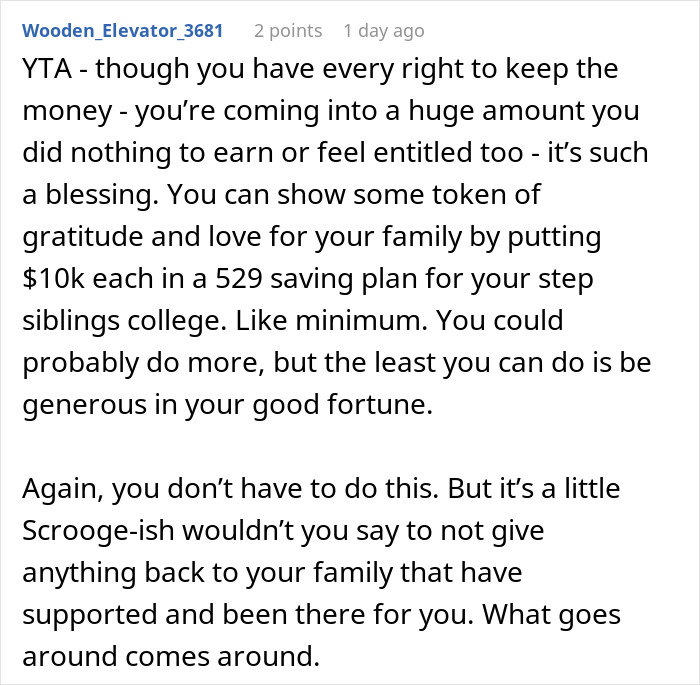

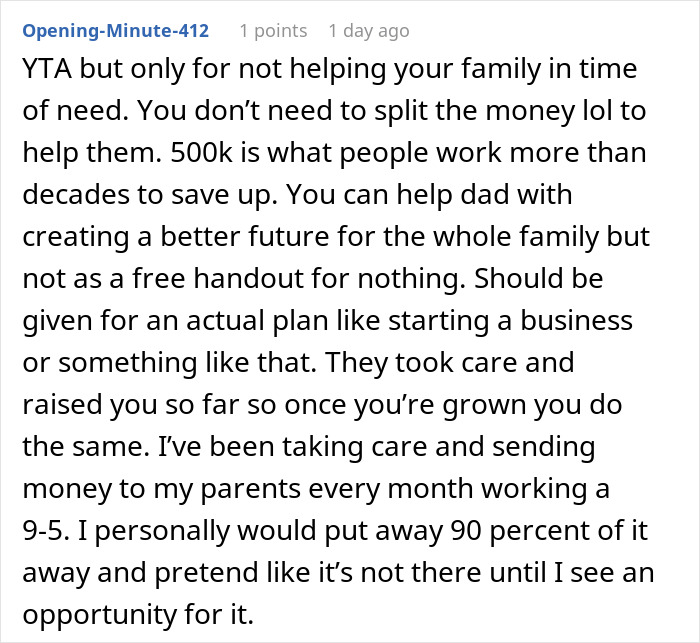

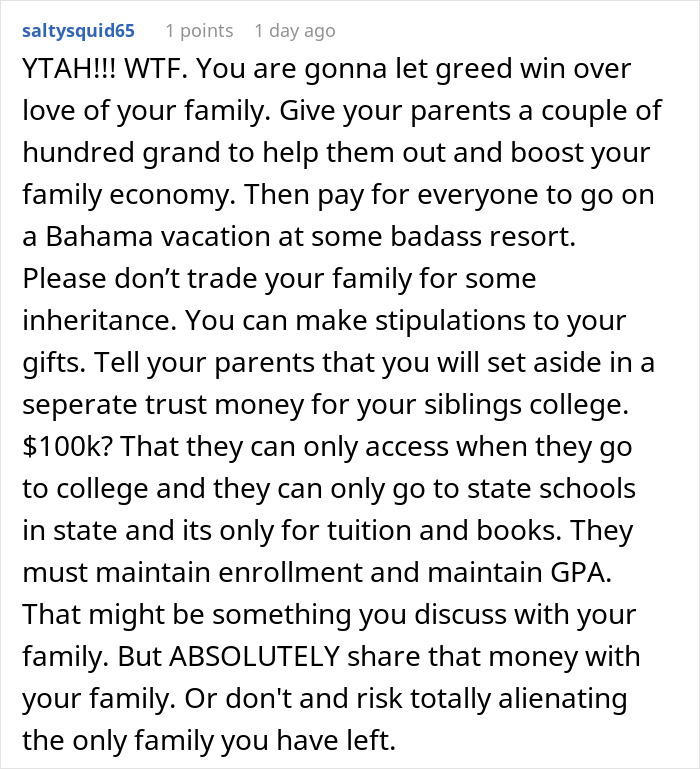

One teen recently found out that he would be receiving a substantial sum of money that his mother set aside for him before she passed away. His father, however, believes that he deserves some of the money to take care of himself and his new family. Below, you’ll find the full story that was shared on Reddit, as well as a conversation with Katherine Fox, CFP, Founder of Sunnybranch Wealth.

This teen recently found out that he would be inheriting a large sum of money from his mother’s side of the family

Image credits: ASphotostudio (not the actual image)

But his father and stepmother believe that they’re entitled to some of the funds too

Image credits: Kindel Media (not the actual image)

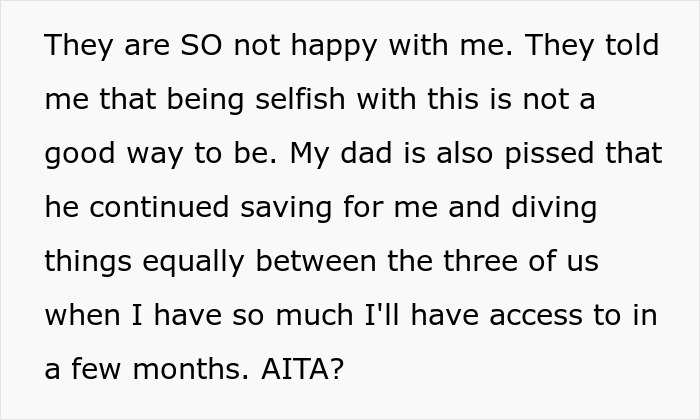

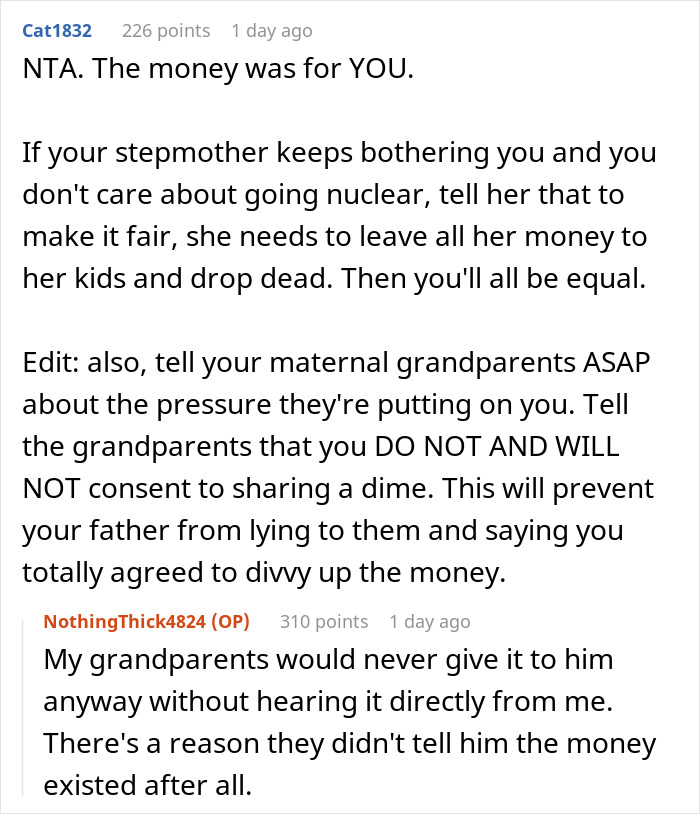

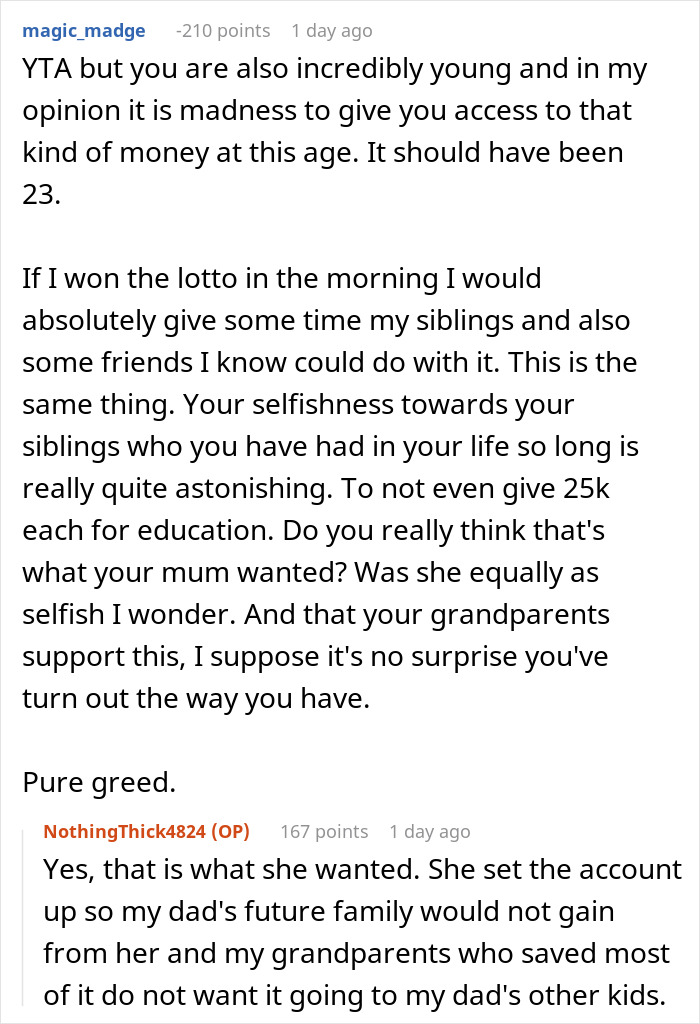

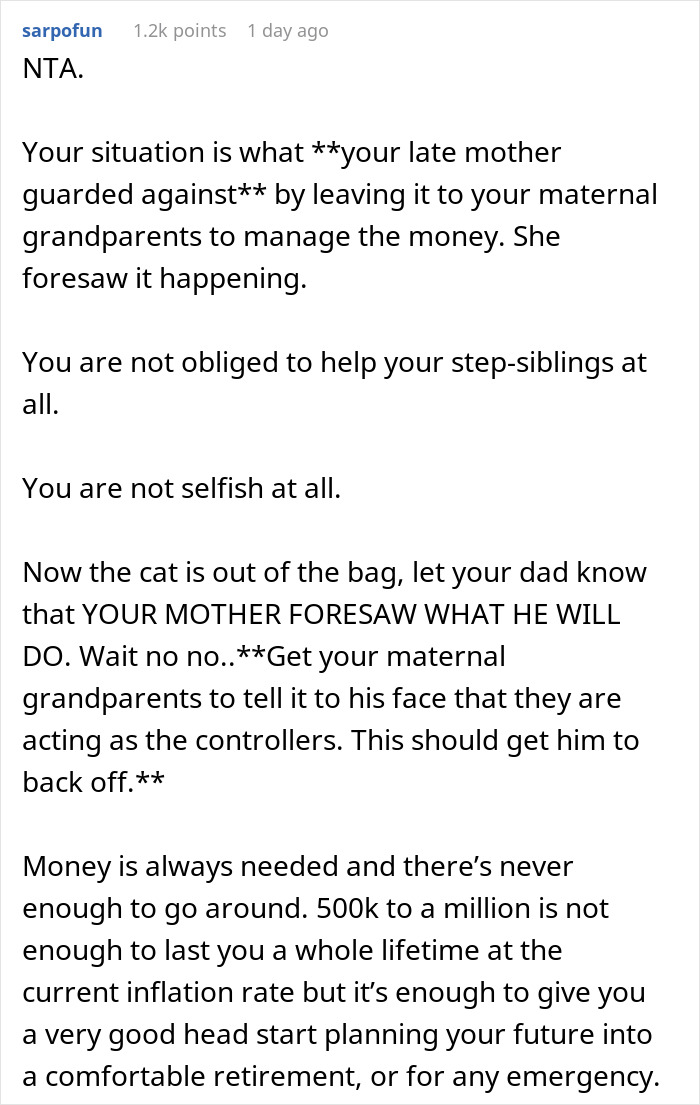

Image credits: NothingThick4824

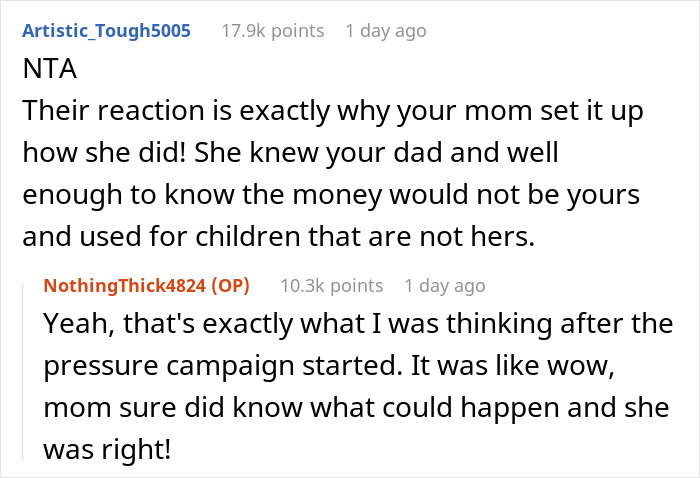

Later, the teen responded to some replies from readers and provided more details on the situation

“[OP’s] mom did a great job by having a plan in place, but she could have taken it a step further to talk about the plan with her husband while she was alive”

To gain more insight on this topic, we reached out to Katherine Fox, CFP®, Founder of Sunnybranch Wealth, an investment advisory firm for inheritors. Katherine was kind enough to have a chat with Bored Panda and explain why it’s so important for parents to have a plan in place for their assets before they die.

“The first reason is to avoid the probate process. When you die without a will, it is called dying ‘intestate.’ When you die intestate, your full estate will go through a state-run probate process and your assets will pass according to the intestacy laws in your state,” Katherine shared. “The probate process can be time-consuming and expensive and it is easier for your heirs to avoid that process.”

“The second reason is to ensure your assets pass the way you want them to. If you die without a will and your assets pass according to your states intestacy laws, you don’t have a say over where money goes after you die,” the expert continued. “These laws vary by state, but typically all money goes to your surviving spouse. If you don’t have a surviving spouse, it may be split equally by your children. If you don’t have children, it would be split by other close relatives. The problem is that not everyone wants their money to go this way! Imagine if [the OP’s] mom hadn’t set up her estate plan – their dad would have gotten all the money and they would have gotten nothing. This is clearly not what OP’s mom wanted.”

Having a plan in place can also prevent fights between family members, Katherine noted. “OP’s mom did a great job by having a plan in place, but she could have taken it a step further to talk about the plan with her husband while she was alive. She could have avoided this situation, he could have understood why money was being left to their child.”

The expert says that disputes between siblings are also common after a parent passes. “Once your parents are dead, you can’t be mad at them for making a mistake and not writing a will,” Katherine explained. “The only person you have to be mad at is a sibling who has a different idea of what your parents would have wanted. It can lead to family-ending fights.”

Image credits: cottonbro studio (not the actual image)

“If you have money that originated a generation or two back on one side of the family, it is common for that money to pass directly to children and skip spouses”

Despite the fact that the father in this story felt he deserved some of his former spouse’s money, Katherine says that spouses are never entitled to inheritance. “If you have a couple who has been married for many years and built wealth together, the surviving spouse would likely receive all/most of the family wealth after the first spouse dies,” she noted. “However, as in [this] situation, if you have money that originated a generation or two back on one side of the family, it is common for that money to pass directly to children and skip spouses. The reasoning is that money should be kept ‘in the family’ and not be made available for use by people who marry into the family.”

“Another common situation when spouses don’t inherit is if someone came into a second or third marriage with assets,” Katherine added. “In that case, money often passes directly to children and avoids the step-parent. This situation can turn extremely messy when the step-parent feels entitled to assets, not unlike OP’s situation.”

In this situation, the expert says it makes perfect sense for the money to go to him, rather than his dad. “This is EXPLICITLY what his mom wanted! This is money that his maternal grandparents made by selling a successful business,” Katherine explained. “Why would their maternal grandparents give money from their side of the family to a son-in-law?”

She noted that two likely explanations exist for the plan OP’s family set up. “One possible explanation is that the teen’s grandparents put a share of their business into a trust for their daughter, with OP as the contingent beneficiary,” Katherine told Bored Panda. “It is also possible that OP’s mom already owned a share of the business and put it into trust for her child. In either case, [the teen’s] grandparents were the trustees and their job was to steward and grow that wealth for him to inherit.”

Image credits: cottonbro studio (not the actual image)

“If he takes the time to educate himself and make smart decisions, this money could set him up for the rest of his life”

“From the AITA post, it is clear that the teen’s mom and grandparents built a plan explicitly so that he would inherit this money,” the expert continued. “They made the conscious decision to exclude OP’s dad in case he remarried and wanted to use the money for his step-wife and other children. And this is exactly what ended up happening! The teen’s mom and grandparents did not want his dad to use the money to support his future family, they wanted the money to stay in their own family. OP is 100% in the right to keep this money for himself. There is no confusion about his mom’s intent for him to have this money for his future needs.”

Katherine added that she feels deeply for the OP. “While he is 100% in the right, it doesn’t feel good to have adults who should know better saying you’re selfish for not sharing an inheritance. If he came to me, I would encourage him to take space from his dad and step-mom while they figure out what to do next. I would not want him to be pressured into giving any (let alone half!) of his inheritance away.”

“This is a lot of money to inherit at 18. OP should lean on his grandparents to figure out how to save and invest his inheritance for the future,” the expert continued. “He is young, and if he takes the time to educate himself and make smart decisions, this money could set him up for the rest of his life.”

“For anyone worried about their parent’s estate plan, or doesn’t have an estate plan in place to protect their kids – PLEASE start these conversations with your family today!” Katherine says. “Imagine if OP’s mom didn’t have an estate plan. This money could have gone 100% to her husband and his new wife and been used to support their kids and family. Do you think they would have shared half of it with OP? I seriously doubt it.”

We would love to hear your thoughts on this situation in the comments below, pandas. Do you think this teen is wrong for keeping his inheritance to himself? Feel free to share, and then you can check out another Bored Panda article discussing inheritance drama!

Image credits: Nataliya Vaitkevich (not the actual image)