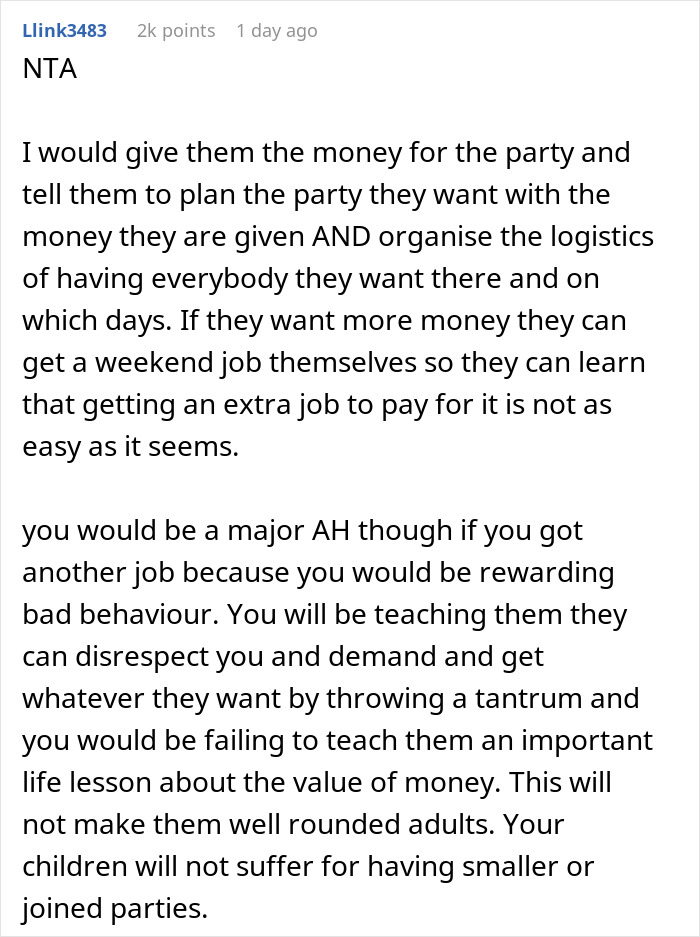

Being a single parent means juggling multiple roles, from provider to nurturer, and while mother and Reddit user Perfect_Phone9777 has been raising not one, but three kids, she’s been providing them everything they need.

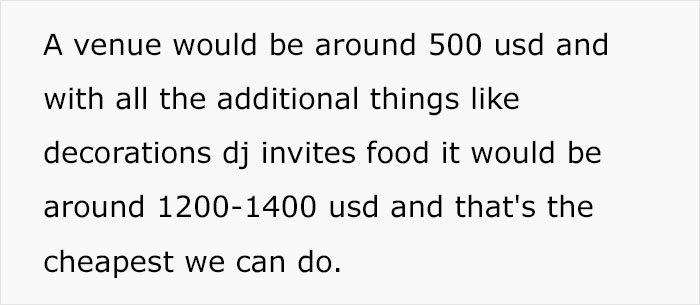

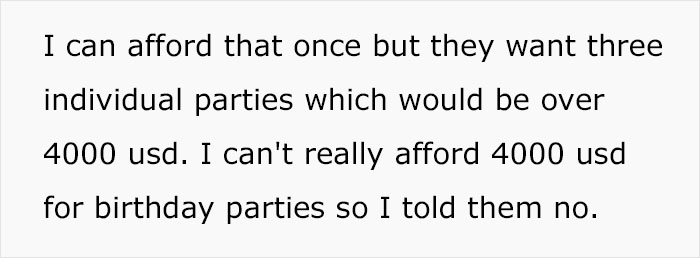

However, when the girls, who are triplets, approached their 16th birthday, they wanted to do something special, individually. The mom broke down the numbers and their needs amounted to $4,000 — a sum she just didn’t have.

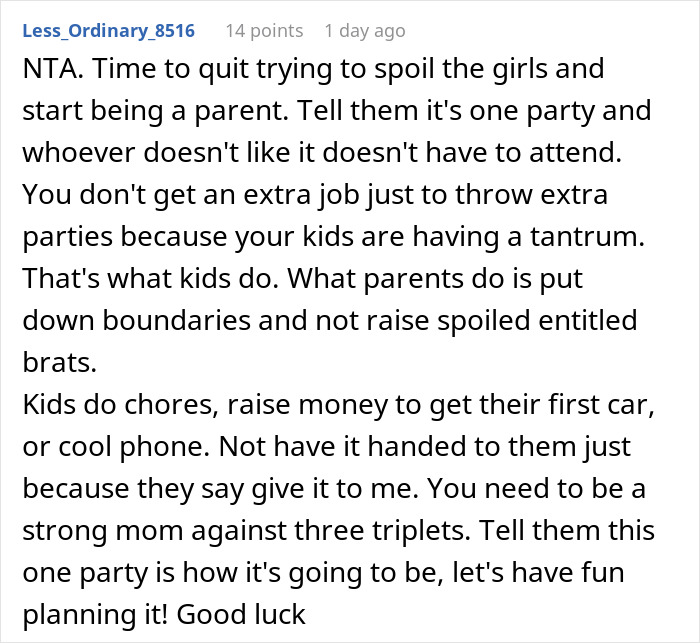

After the family failed to find a compromise, the woman made a post on the ‘Am I the [Jerk]?‘ subreddit, explaining the situation and asking its members to share their take on it.

For many, a sweet sixteen is not just a birthday party, it’s also a coming-of-age celebration

Image credits: Gabe Pierce (not the actual photo)

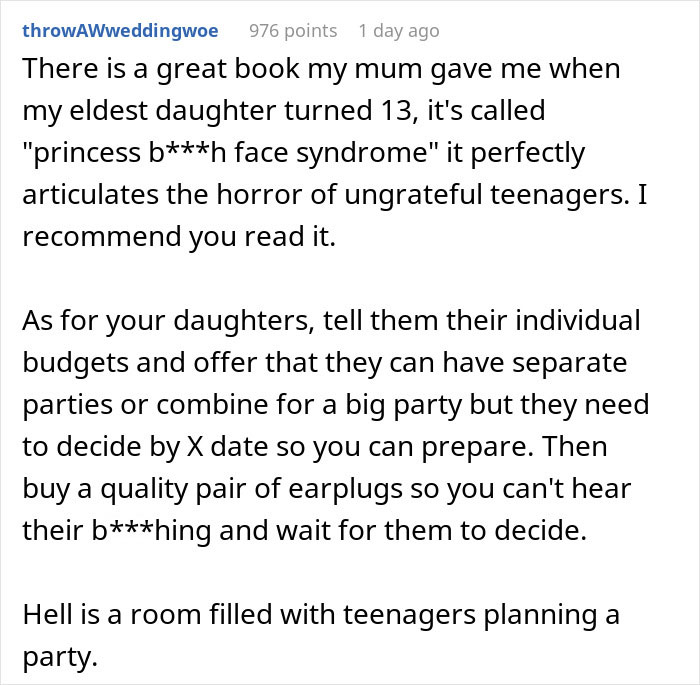

But this parent just couldn’t pay for what her triplet daughters wanted

Image credits: Liza Pooor (not the actual photo)

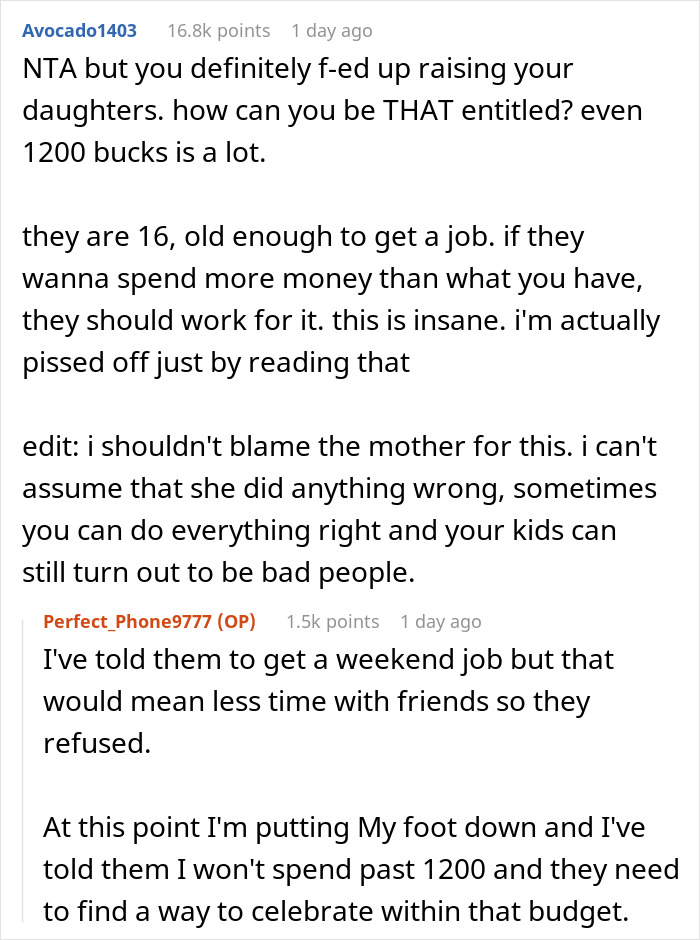

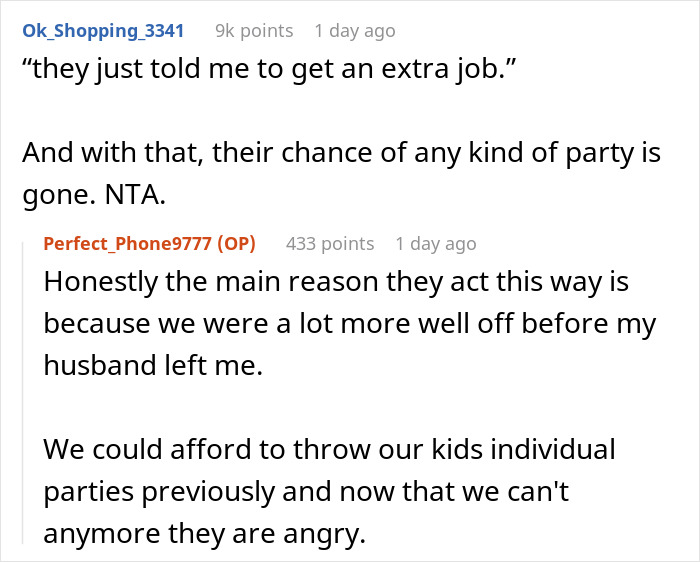

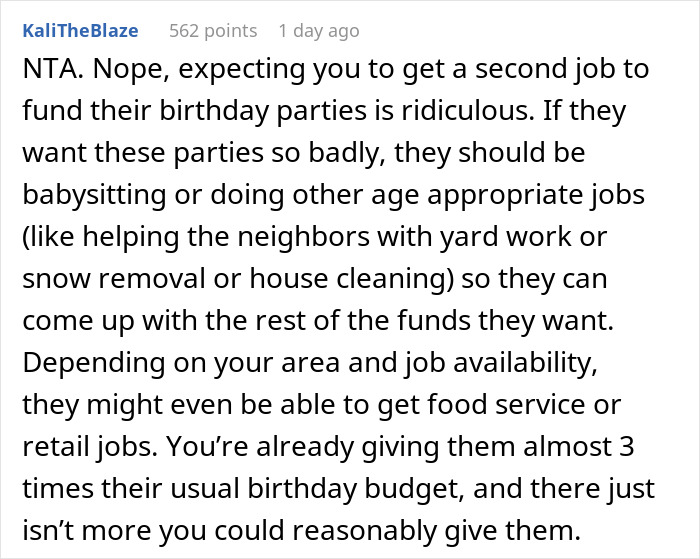

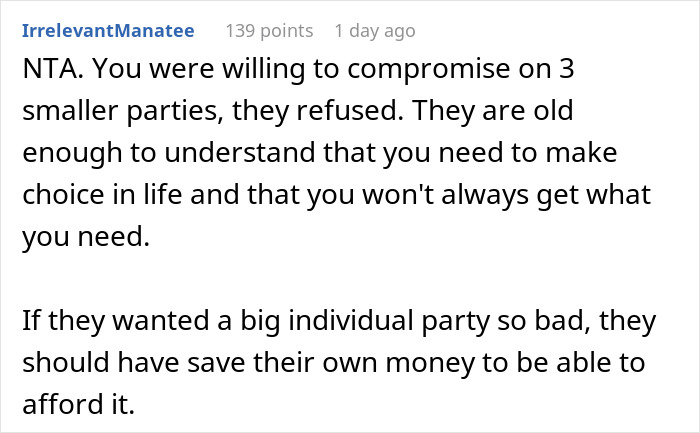

Image credits: Perfect_Phone9777

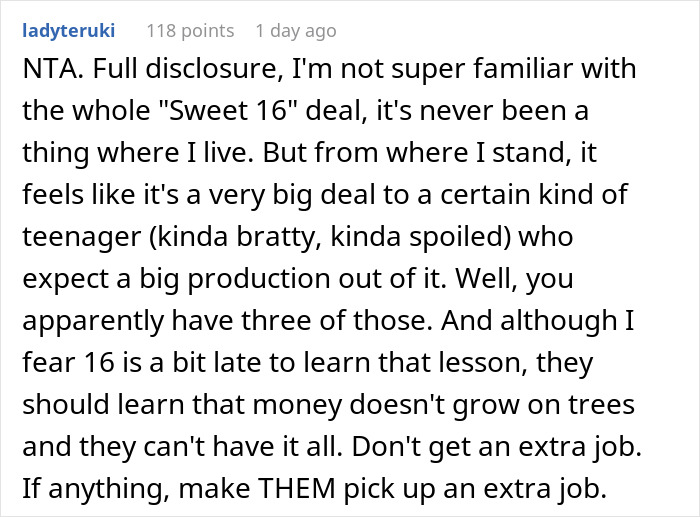

The girls need to take into account that every dollar matters when you’re on a tight budget

The fact that the author of the post can put away over a thousand bucks for her kids’ birthday is quite remarkable.

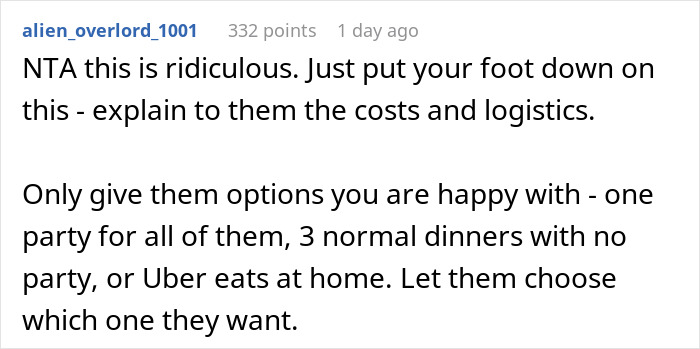

Research by LendingTree shows that raising a child from birth to age 18 now costs Americans an average of $237,482. And as with other major household spending categories, like health care and college, the tab for bringing up kids is surging — the average annual cost of child-rearing stood at $21,681 in 2021 — up almost 20% from 2016.

Those figures encompass only what researchers described as the “bare bones,” including money for food, housing, child care, apparel, transportation, and health insurance, as well as the impact of tax benefits such as the Child Tax Credit.

They don’t include enrichment activities such as sports, after-school classes, and the like, let alone the soaring cost of attending college, which could single-handedly double the total sum, depending on where someone lives and what type of school their child attends.

While the teens continue to expect lavish birthday parties, they probably aren’t aware of just how scrupulous their mom needs to be in today’s economy.

“Most people’s financial margin for error is pretty tiny, and a few hundred dollars here and there can be really significant when you are on a tight budget,” Matt Schulz, LendingTree chief credit analyst, told CBS MoneyWatch.

Image credits: Pixabay (not the actual photo)